Retention and Remarketing

Independent insurance agents know the challenges of retaining clients even in the best times. In the current market, agency teams likely are working harder than ever to keep customers who are upset about higher premiums and restricted coverage. Those soft-dollar costs, like staff time spent away from prospecting or cross-selling, will impact any firm’s bottom line in the long run.

As noted in the recent Trusted Choice “Navigating the Hard Market Agent Survey,” understanding market conditions plays a significant role in retaining clients, especially in states like Florida, where insurance options are limited and may be prohibitively expensive. Therefore, agents must know why certain areas or clients may be facing non-renewal from their existing carriers or more stringent underwriting requirements from new ones. They also need to know how and when to remarket clients, as well as the various options to provide the best coverage at the best price.

In part two of the survey, learn what successful agents are doing to retain clients and remarket their business when necessary.

Retention and Remarketing: More Than Price

Independent agents know that client retention relies on many variables, and price isn’t the only factor. However, 39% have prioritized clients by the largest premium impact to the client. With smaller percentages of member agencies refocusing their teams by size of account (8%) and complexity of account (7%).

“We balance size with complexity and importance of the account to the agency,” one agent notes.

Agents also are more selective about which clients they’ll work with. As one survey respondent says, “We are only quoting new prospects if [they are] being non-renewed or [making a] new purchase in personal lines. We are not able to quote people calling for premium comparisons.” Other agencies may have a different approach. Each firm must evaluate what is best for its business and implement that process for both profit and efficiency.

Timing is critical in managing renewals, with the majority of agents working at least one to three months in advance. One agent comments, “Two years ago, we stopped being able to only remarket policies that had more than 15% increases. Now, everyone has to be reviewed against all markets.”

Another survey respondent encourages agency staff to view remarketing as a learning experience: “How can we find different and new brokerages or carriers to meet our insured’s needs?” Another agent tells staff to “keep focused on new carriers and products.”

The most telling comment? “Virtually everyone is shopping as we are also shopping for our insureds.”

Not all employees may understand the importance of retention, however. As one principal notes, “It hasn’t hit the sales agents that retention is more important than ever. It’s fallen on the CSRs to do the retention work. I can’t seem to convince my coworkers that picking up that phone and having this hard conversation is the best way to retain business.”

What Agents Are Saying

Brian Ford, CIC, Principal and Agent, Insurance Resources, Florida

The biggest challenge Ford faces is that the state-run Citizens Property Insurance has a significant share of the market, and private insurers often can’t compete with its rates. “We look at all renewals and then compare Citizens, admitted carriers and the excess & surplus markets to ferret out alternatives and supplement the policy gaps,” Ford says. “And we are seeing more instances where our customers are self-insuring some or all of the property risk.”

Frank Kolovic, Insurance Consultant, New York

Kolovic, who currently advises commercial lines clients in the New York metropolitan area, faces the challenge of a heavily regulated insurance market with the strictest workers compensation laws in the U.S. As a result, like Florida, some carriers choose not to write in the state, reducing available insurance choices.

Kolovic relies on his experience and knowledge to craft solutions for his clients. “As I moved into property-casualty insurance,” he says, “I realized I needed to take time to learn the nuances of policy forms. Understanding the differences in policy forms among insurance companies provides the agent with alternatives to present that can mitigate the impact of pricing, underwriting restrictions and endorsements.”

Chris Orletski, President, Blankit Insurance Group, Florida

Blankit Insurance Group’s retention rate has gone down from 96% to 82% due in part to clients selling their homes and relocating, Orletski says. About 25% of the firm’s personal lines clients have no private carrier options and are insured by Citizens, the state-run market of last resort.

The agency has had to be more selective about what business it will take on and declines accounts when the insured is merely price shopping, and the only option is Citizens. The firm has tapped into outside resources from the Trusted Choice Hard Market toolkit to solve complicated issues for customers.

Annmarie Westerfield, Chief Operating Officer, Cupo Insurance Agency, New Jersey

The agency has always ensured clients are getting the best product and price at renewal time and doesn’t remarket accounts unless it is a true benefit to the clients, Westerfield notes.

For larger accounts like apartment buildings and condos, renewals have been extremely difficult, with much more limited coverage, higher premiums and additional exclusions. On one renewal, the carrier added a sublimit for snow and ice claims, about which Westerfield says, “That was really the only option we could offer to them. I’ve never come across that before, and it worries me that I am going to see more of it.”

Agent Solution: Know When to Remarket

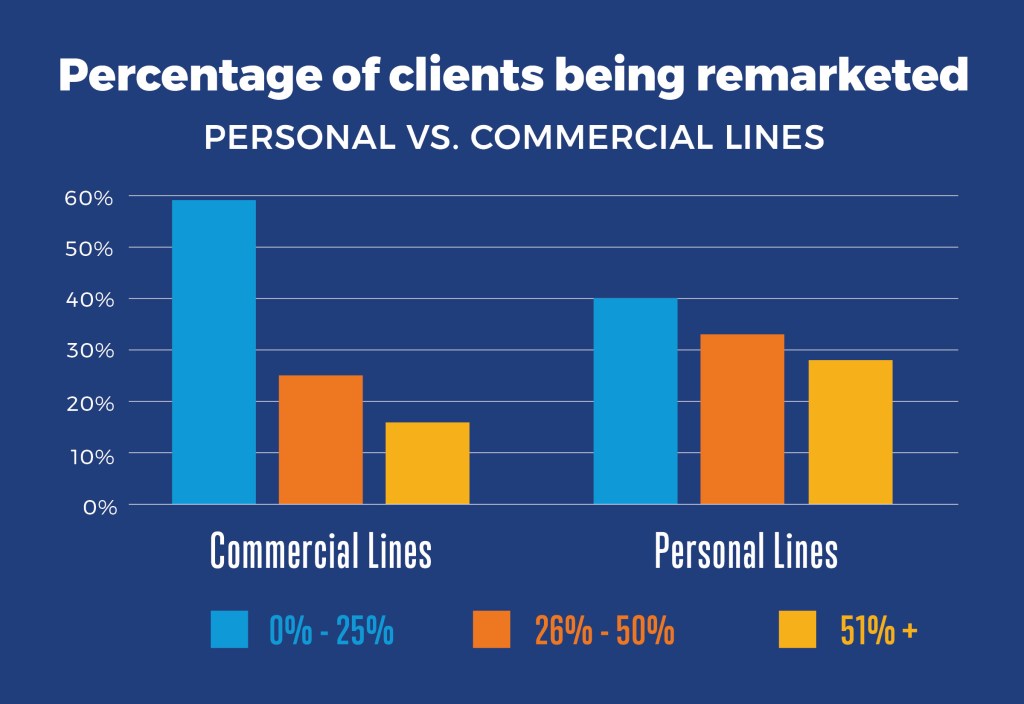

A remarket is one of the most labor-intensive activities your team can do. And with increased rates, remarketing has been on the rise. Need a place to start? Download the Remarketing Standards sheet that is part of the Trusted Choice Hard Market Toolkit. The target remarketing ratio is 60-70%. When you remarket intentionally, you can reduce the number of remarkets and remarket only when it’s the best thing for the client.

One respondent, who leads commercial lines for a Midwest agency, builds a story and a history with the carrier when remarketing a specific client. Agents strive to create a relationship so that when unique risk situations arise, the company has confidence in the insured and is willing to provide some underwriting latitude. When the agency must remarket a client’s business, the team engages with carriers 120 to 60 days out from renewal for a preliminary quote.

“Ten years ago, we could take a more consultative approach, with most clients just paying their premium and assuming their coverage was what it needed to be,” says the division operations manager of a Pennsylvania-based agency. “Now, clients come to us with a lot of questions. They want to understand the increases, deductibles, and changes in coverage. Most of all, they want to know how they can save money, and they ask the agency to remarket their policy much more often than they did in the past.”

Smart agents know that while remarketing a policy may seem like the best path to lower costs, it comes with inherent risks. Agents say they’re careful to alert clients on the issues created by shopping for different coverage options. Moving a client’s policy to a different carrier can negate certain policy longevity advantages, such as premium savings found in loyalty discounts, loss-free discounts and deductible relief. “After we explain the advantages of staying the course, most clients become more comfortable with their current policy,” the Pennsylvania agency manager says.

Need more support in this hard market? Check out the full suite of resources we have for agents here.