Research Report: Navigating the Hard Market

With evolving client preferences, shifting consumer demographics, and increasing pressure on consumers from rising premiums, the need for effective communication has never been greater.

A recent Trusted Choice Hard Market Agent survey of Big “I” member agents revealed a compelling trend: Agents are prioritizing communication and investing in educating clients.

Let’s delve into the survey insights and discover how successful agents understand and embrace the power of communication and education to stay ahead.

Communication with Clients is on the Rise:

Insurance is a relationship business. Proactive, consistent, and clear communication is key to keeping those relationships intact, especially in tight market conditions.

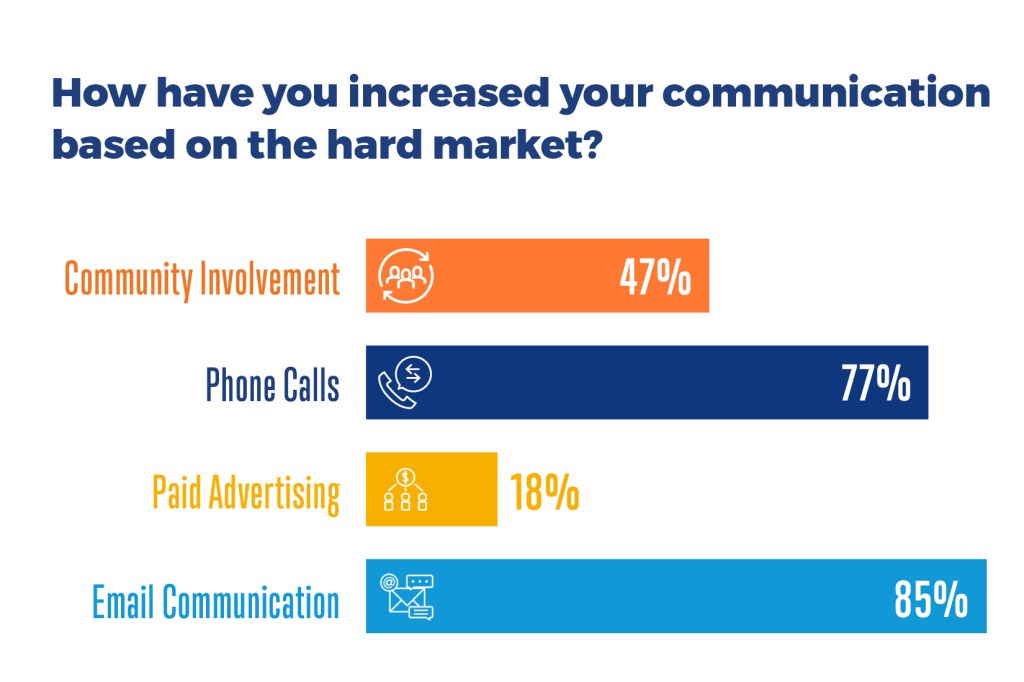

According to the Trusted Choice Hard Market Agent Survey, 65% of agencies have increased their communication to policyholders. Almost 90% of agencies are sending more emails, and 21% are increasing their paid advertising. Although 27% of agencies put more resources toward marketing, 18% cut their marketing spend, saying they are using other ways to reach clients and prospects.

One personal lines agency in Pennsylvania relies on the templates in the Trusted Choice Hard Market Tool Kit to produce regular client emails. “It’s a good opportunity for us to touch base, even well before renewals, and although we use automated communication using names pulled from our agency management system, the messages look personal and usually include two simple questions to prompt discussion,” the division operations manager said.

The survey found that the majority (80%) of members also increased telephone contact, and 47% increased their community involvement. Agents have long been known as the sponsors of local youth sports teams, for example, and increasing their visibility in the community is another way to remind clients and prospects that they’re not going away.

Chris Orletski, president of Blankit Insurance Group, based in Florida, notes his firm has had to have many tough conversations with clients who don’t understand why only one option is available to them. He summed it up nicely: “Sprinkled in all the terrible things, we do hear from clients, ‘Thanks for doing this,’ and that definitely makes it worth it.”

What Agents Are Saying

Frank Kolovic, Insurance Consultant, New York

“It is first and foremost about the relationship I have with my clients.” He maintains in-person contact with clients to discuss relevant aspects of the hard market. “You have to be honest” with customers when the news is not what they want to hear, he explained, but assure them that you will be working earnestly on their behalf to help solve their problems.

Annmarie Westerfield, Chief Operating Officer, Cupo Insurance Agency, New Jersey

The agency is communicating with clients early about what they should expect at renewal time so they are aware and prepared for what may come. “It’s much better right now to get in front of it and help them understand the process and that we are trying to get the best result for them.”

Brian Ford, CIC, Principal and Agent, Insurance Resources, Florida

“No one wants to pay attention to insurance until it hits them in the face,” said Ford. “But given the breadth of the hard market, people have become aware of the importance of insurance in their personal and business lives. Our goal is to be that trusted advisor.”

The firm has used its agency management system tools to proactively communicate and share information from outside newsletters, flyers, local articles and Wall Street Journal articles.

Agent Solution: Education First

What might agents do to improve client communications, especially in these difficult market conditions? First, be proactive and get ahead of renewals by communicating clearly and regularly with clients. There is no need to sugarcoat the reality that coverage may not be affordable. But be sure clients know you’re scanning the marketplace and working on their behalf. Prioritize empathy to retain clients while preparing them for changes.

In addition to traditional marketing techniques, 75% offered clients more educational content on market conditions. In some states, for example, where carriers have pulled out of the market or are charging significantly higher premiums, agents have the difficult task of explaining why certain coverage is no longer available or reasonably affordable in their area.

A branch manager of a Southeast agency commented in the survey that when clients are forewarned and understand changes, that can soften the blow. This engaged approach also positions the agency as the client’s best advocate and differentiates the firm from competitors who passively react to market conditions. “Our philosophy is to be compassionate and empathetic — to let clients know we understand their frustrations. We’re even dealing with the same issues on our own personal insurance,” the branch manager said.

One respondent, the head of commercial lines for an agency in the Midwest, said “a lot of education” is the centerpiece of the agency’s approach during all market cycles. The firm recognized that most companies’ budget cycle is months before their fiscal year begins. During regular customer meetings and calls, producers tell clients what they believe the customer can expect regarding pricing, policy and underwriting restrictions during the upcoming cycle.

Yes, these times are tough. Agency staff need a lot of energy to keep things positive when customers’ pocketbooks are getting slammed. While independent agents can’t control the marketplace, they can control their attitude and conversations with others. Producers and CSRs should view every conversation as a marketing opportunity to educate prospects and clients in a non-pushy way.

With renewed attention to educating clients and using marketing-communications tools, many agents are doing just fine amid these painful market conditions.

Need more support in this hard market? Check out the full suite of resources we have for agents here.